I’ve been actively researching customer behavior in the financial and retail industries for over 30 years now, and what fascinates me the most is determining the leading indicators of future customer choices and interactions. At Corios we call this predictive customer journey analysis.

The most important and most elusive part of being responsive to customer journeys is identifying leading indicators. Leading indicators will tell you what each customer is likely to need or want, in advance of the customer making a decision, in a way that gives the firm enough time to prepare and respond with a relevant solution.

The most important and most elusive part of being responsive to customer journeys is identifying leading indicators. Leading indicators will tell you what each customer is likely to need or want, in advance of the customer making a decision, in a way that gives the firm enough time to prepare and respond with a relevant solution.

Predicting future customer activity is more important than merely observing past activity. If used correctly, history can be a wonderful predictor of future choices. However too often, marketing recommendations are based on customer averages, rather than on trends or events. The customer average is a good predictor if we have no other information, but in this era, we have much more information available to help predict the customer’s next actions. Being aware of, and utilizing this information effectively, is vital. Often firms have one shot at delivering a relevant solution within a finite window of opportunity. Once that window closes, another opportunity may not present itself for days, months or years.

To underline the importance of effectively tackling the challenge of predictive customer journeys, I’ve researched the actions of our Corios clients, and catalogued the five practices that lead to the biggest differences between successful and less-than-successful efforts.

1) Set predictable goals, and monitor progress towards achieving them

Do you remember the era of web server logs and vendors like WebTrends? Amazingly, they are still in business, a few blocks away from Corios HQ in downtown Portland. When their software first emerged, it was a very solid way of reporting web server statistics: pages, hits and errors (the reports always reminded me of baseball scores.) However, what has always been missing from these reports was any indication of whether the firm using the web server was actually making any money from customers. A problem that is still relevant now. Business owners receive too many reports providing historical perspectives on activity, rather than whether these activities moved the needle by delivering meaningful value to their customers.

Today, these activity reports take the form of interactions across channels, hopefully integrated to the customer level, but the problem still remains that none of these reports inform decision-makers as to whether key objectives are being met, improved, or diluted, as the result of said activity.

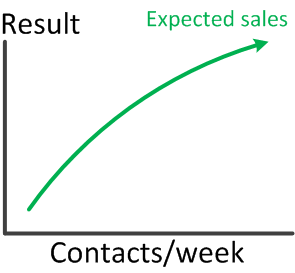

Which brings me to my first “difference-making” action when considering customer journey analysis: Can the firm’s decision-makers trace a direct line from interactions to value-producing objectives? The path between interaction and valuable objective should go straight through an applied analytic model that identifies which interactions produce value, such as incremental closed sales or increased value per sale, as opposed to being completely irrelevant.

When this line of sight between activity and outcome is clear, unambiguous, and a leading indicator, decision-makers can redirect resources toward stimulating the most value-producing interactions with customers.

Read More

The most important and most elusive part of being responsive to customer journeys is identifying leading indicators. Leading indicators will tell you what each customer is likely to need or want, in advance of the customer making a decision, in a way that gives the firm enough time to prepare and respond with a relevant solution.

The most important and most elusive part of being responsive to customer journeys is identifying leading indicators. Leading indicators will tell you what each customer is likely to need or want, in advance of the customer making a decision, in a way that gives the firm enough time to prepare and respond with a relevant solution.